Liquidity & Volatility

Reviving the problem of poor liquidity after the SPX dropped 80 handles in 30 minutes.

Today the S&P500 dropped 80 handles in two minutes, reviving our concerts about liquidity holes. The trigger was a poor 20 year treasury auction.

The liquidity hole concept is that when risk flares, much of the available liquidity disappears, leaving wide spreads and little size on the bid or offer. Therefore, anyone that has to trade, is forced to pay those wide spreads and trade through many price levels in order to complete their order.

In early April Goldman noted some of the lowest liquidity they had ever seen - and that was at a time when equity and options volumes hit highs. The result of this flow was that the VIX hit +60, and the SPX traded down 10%.

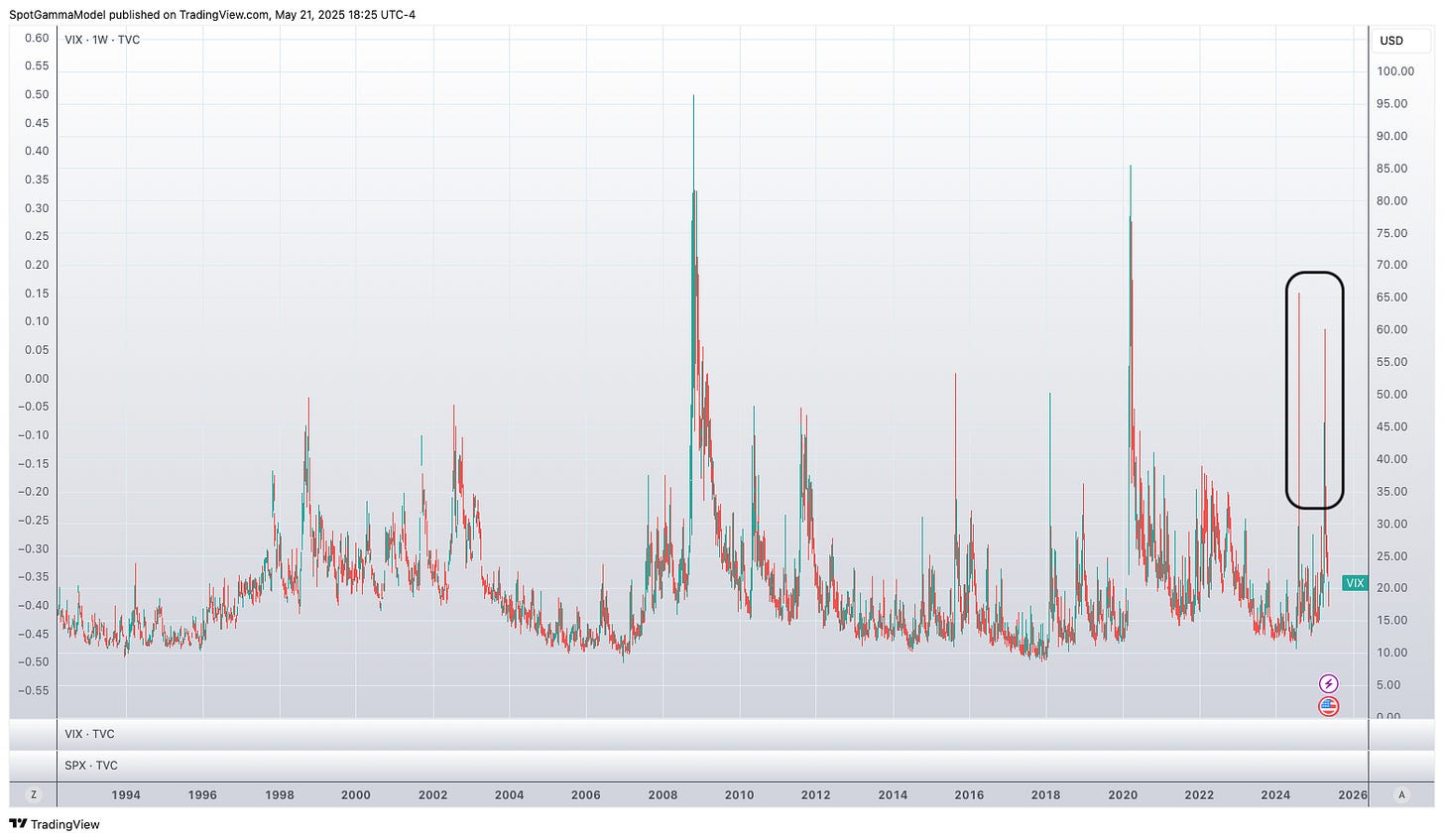

What is troubling about this, is that we believe a similar liquidity driven VIX spike was behind the August ‘24 VIX spike over 50. And, while 2 VIX spikes don’t make a trend, we’d note that the there was only 2 prior VIX moves over 50:

March ‘20 Covid Crash

October ‘08 & the GFC

Today’s sudden equity drop suggests to us that the liquidity problems were not cleared up with the markets recent rally - and that poses a threat for equity investors.

All of this is broken down - with “receipts” - in our May ‘20 episode of the OPEX effect. Start here (44 mins in) to jump to the topic of liquidity and volatility.